Brookmount Gold (OTCMKTS:BMXI) Stock Surges As Company Shows 30% Growth in Sales and Increases Assets in Q3 of 2022

Brookmount Gold (OTCMKTS:BMXI) has reported a 30% improvement in sales in Q3 of 2022, as compared to the same period in 2021. During this quarter, the company’s revenue went up to $4.53 million, up from $3.49 million recorded in Q3 of 2021.

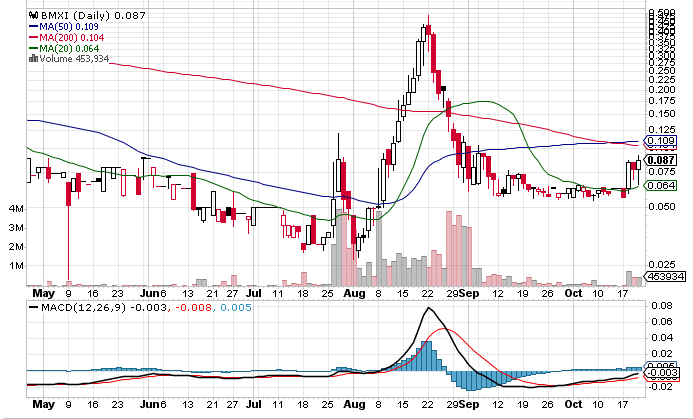

Trading Data

On Thursday, BMXI stock increased 11.86% to $0.0873 with 453.93K shares, compared to volume of 1.04 million shares. The stock moved within a range of $0.0651 – 0.0920 after opening trade at $0.0780.

Brookmount Gold Posts A 30% Sales Increase And Strong Asset Growth In The Third Quarter Of 2022

Brookmount Gold, founded in 2017, is a high-growth gold-producing company incorporated and listed in the United States. It holds a strong portfolio of exploration and production assets in gold projects in Indonesia (Talawaan and Manado), Canada (Moosehorn), and the United States (McArthur Creek in Alaska), increased its production by 34%, as per the 90-day AVE gold price. Gold is a safe haven asset that is typically not affected by inflation.

For the reporting period June 1st-August 31st, the earnings results were filed this week with OTC Markets. They indicate the company’s EBITDA grew over 39% during the Q1-Q3 of 2022, up to $7.64 million, compared with the same three months of 2021. As an outcome of the financial strategy pursued by Brookmount in the past 12 months, its liabilities decreased by 57% and are already under one million dollars.

By August 31st, 2022, Brookmount’s sales for the nine months were at $13.15 million, or a 36% increase over the first nine months of 2021. In the same period, year on year, its EBITDA increased by 34.6% to $2.698 million. In addition, its total assets are now $28.13 million, well over the Q1-Q3 2021 period.

Key Quote

“We are very pleased with the results recorded this quarter and the strong growth of our assets. Brookmount Gold continues to focus on its strategy to become a strong player in the gold mining ecosystem,” said Nils Ollquist, its CEO.

Traders Corner

BMXI stock is trading below the 20-Day and 50-Day Moving averages of $0.0700 and $0.1087 respectively. Moreover, the stock is trading below the 200-Day moving average of $0.1040.