Grillit Inc. (OTC: GRLT) Stock Surges on Merger News

Following the significant development on Monday, it is likely that the Grillit Inc. (OTC: GRLT) stock came into sharp focus among investors. Yesterday, it emerged that the noted private equity real estate investment outfit Primior Inc. had completed its merger with Grillit.

Primior Inc. completes merger with GRILLiT Inc.

In the news release, it was noted that the transaction, worth $30 million, would further strengthen Primior’s market position as a major player in the real estate development and investment space. Additionally, the merger would also help Primior in broadening its reach at an operational level and moving into new sectors like tokenization.

Thanks to the merger, Primior would get access to Grillit’s public platform. In this context, it ought to be noted that Primior boasts of more than $1.5 billion in assets under its management, and the merged entity would be focused on innovation, diversification, and sustainable growth. Primior has so far distributed as much as $502 million to its global investors.

As part of the merger, the innovative real estate investment strategies of Primior would be combined with the varied investment opportunities offered by Grillit. The merged entity would be primarily focused on acquisitions, tech-backed initiatives, and real estate financing. It remains to be seen if the Grillit stock continued to be in focus through this week or not.

Key Quote

Johnney Zhang, CEO and Founder of Primior, stated, “This merger represents a transformative leap forward for Primior. By joining forces with GRILLiT, we are able to accelerate our strategic initiatives, broaden our service offerings, and leverage the benefits of being part of a public company. This is a key step in positioning ourselves at the forefront of real estate and technology investment.”

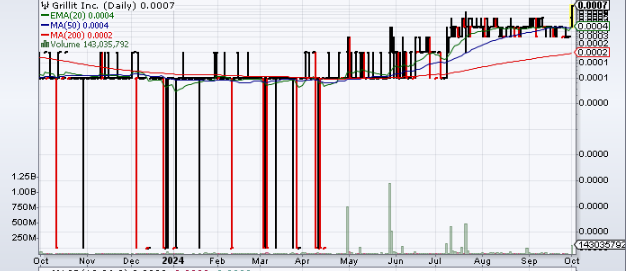

Basic Technicals

| +/- EMA(20) | 0.0004 (+50.00%) |

| +/- SMA(50) | 0.0004 (+50.00%) |

| +/- SMA(200) | 0.0002 (+200.00%) |