Xtra Energy Corp. (OTC:XTPT) Stock In Focus After Latest News

On Thursday, Xtra Energy Corp. (OTC:XTPT) hit the radars of investors after the company announced that the petrographic studies on mineral samples from its American Antimony Project had started.

Xtra Energy Corp. Initiates Petrographic Studies for the American Antimony Project

In the news release, Xtra Energy Corp announced that it was a major milestone in its aim to develop the company’s flagship asset. The study would look to improve the understanding of the mineralogical character and also to figure out the most efficient antimony extraction methodology. Antimony is a critical mineral for a range of industries like energy storage, defense, and electronics.

Further Details

The petrographic study in question would be headed by Dr. Allen Miller, based out of Ottawa, Canada. The analysis would concentrate on the identification of textures, distribution of antimony-bearing minerals inside the core, and textures, among others.

Xtra Energy Corp. went on to note that the analyses would provide key understanding about the geometallurgical model of the American Antimony Project. It would also help with making the current exploration and extraction process more efficient.

The project is situated at the Bernice Canyon in Churchill County, Nevada. The region is well known for antimony mineralization of the highest grade. At a time when the worldwide demand for antinomy is on the rise, the project could play a major role in the antimony supply chain.

Management Comment

“We are excited to take this crucial step in advancing the American Antimony Project. The petrographic studies will enable us to better understand the mineral composition and processing characteristics, further refining our future approach to sustainable and efficient extraction,” said Mac J. Shahsavar, P.Eng., Chairman and CEO, of Xtra Energy Corp. “This is part of our commitment to ensuring a responsible supply of antimony for industries that rely on this critical mineral.”

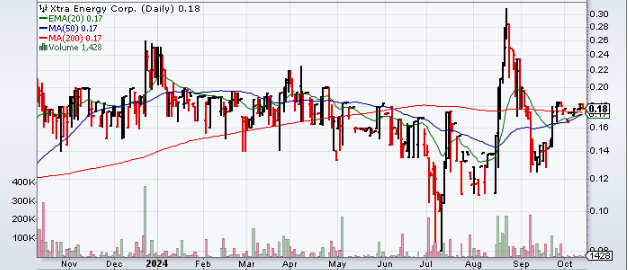

Technicals

| +/- EMA(20) | 0.17 (+4.41%) |

| +/- SMA(50) | 0.17 (+4.41%) |

| +/- SMA(200) | 0.17 (+4.41%) |