Allied Energy Corporation (OTC: AGYP) Provides Key Growth and Strategic Update

When a company makes key announcements about an exciting future and enumerates the key reasons behind such optimism, it may be a good move to take a closer look. On Thursday, it was Allied Energy Corporation (OTC: AGYP) that made such an announcement, and in this feature, we will take a closer look.

The Announcement

In the news release, the company announced that it had made major progress in its current projects and with regards to the expansion of its production capacity. Allied Energy Corporation noted that such progress had been one of the major reasons behind the current optimistic outlook. Thanks to the momentum delivered by such major progress, the company stated that it had attained a position from which it could grow substantially over the course of the upcoming months.

Further Information

Another key aspect of Allied Energy Corporation’s continued progress was its commitment to the strengthening of its infrastructure. The company went on to note that it was also working on ways to create scalability for the long term and for delivering much better financial performance. Eventually Allied Energy Corporation will be in a position to compete well with the industry leaders, it was noted.

CEO Quote

“By strengthening our infrastructure now, we are ensuring long-term scalability, improved financial performance, and the ability to compete with industry leaders in power generation and energy solutions. The Thiel is a key site in our portfolio, and we are very pleased with the progress. We expect to see strong returns from these investments, and the addition of the third genset will significantly enhance our operational capabilities,” said George Monteith, CEO of Allied Energy Corporation.

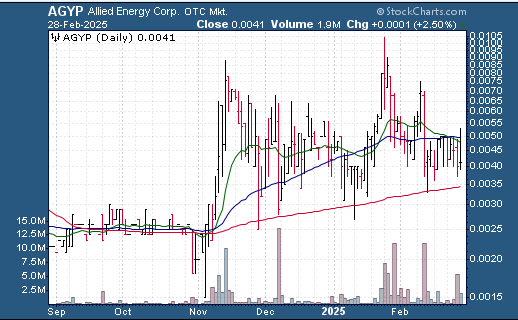

Technicals

| +/- EMA(20) | 0.0048 (-14.58%) |

| +/- SMA(50) | 0.005 (-18.00%) |

| +/- SMA(200) | 0.0034 (+20.59%) |

| 5-Day Perf. | -18% |

| 1-Month Perf. | -51.76% |

| 3-Month Perf. | -6.82% |

| 6-Month Perf. | +86.36% |

| YTD Perf. | -2.38% |

| 1-Year Perf. | +64% |

| RSI(14) | 44.7 |

| ATR(14) | – |

| ADX(14) | 9.82 |

| Beta (5Y) | 0.48 |