Atlantic Power & Infrastructure Corp (OTC:AWSL) Stock On Watgclist After Key Updates on Humber Estuary Project

Could Atlantic Power & Infrastructure Corp (OTC :AWSL) be the one to watch this morning? On Tuesday, the company had been in the news cycle after it made a major new announcement with regards to the completion of a project. Let’s take a look into it a bit more closely.

Major Project Completed

The company, along with K B Industries UK Ltd, its fully owned subsidiary unit, jointly announced that a major project for the Humber Estuary located in the United Kingdom, had been completed. Atlantic Power & Infrastructure Corp announced in its news release that the Humber Estuary was a huge wildlife conservation and port complex and the second biggest such coastal plain estuary in the country. Additionally, KB Industries had earlier installed around 30000 square feet of KBI Flexi Pave pathways in connection with the Skeffling Managed Realignment Scheme.

Further Information

The company went on to state that the project had also been funded by the Environment Agency in part and had also involved the building of a new sea embankment further into the land. The KBI Flexi Pave product was selected for its porous and sustainable nature. It remains to be seen if the Atlantic Power & Infrastructure Corp stock gets any action today or not.

Management Quote

Paul Craig, Project Manager with JN Bentley Ltd., stated, “The Flexi®-Pave surface is an exceptional product. The team at KBI demonstrated outstanding professionalism throughout the project, delivering work of the highest standard. They were, without a doubt, the best subcontractors we worked with during the entire project.” By allowing seawater to flow in, the project aims to create new intertidal habitats that will support a diverse range of wildlife, including rare and endangered bird species.

Technicals

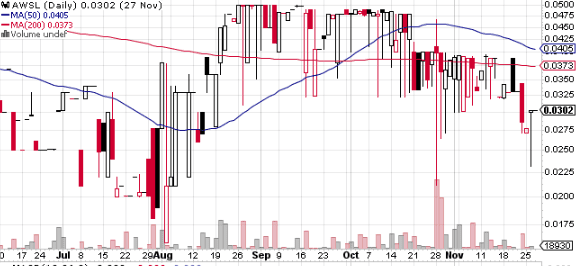

| +/- EMA(20) | 0.0343 (-11.95%) |

| +/- SMA(50) | 0.0405 (-25.43%) |

| +/- SMA(200) | 0.0373 (-19.03%) |

| 5-Day Perf. | -8.76% |

| 1-Month Perf. | -24.5% |

| 3-Month Perf. | -39.48% |

| 6-Month Perf. | -27.05% |

| YTD Perf. | -35.74% |

| 1-Year Perf. | -41.92% |

| RSI(14) | 39.23 |

| ATR(14) | 0.01 |

| ADX(14) | 60.59 |

| Beta (5Y) | 0.09 |