Elray Resources Inc. (OTCPK:ELRA) Stock Surges On Strategic Sale of Crypto iGaming Technology

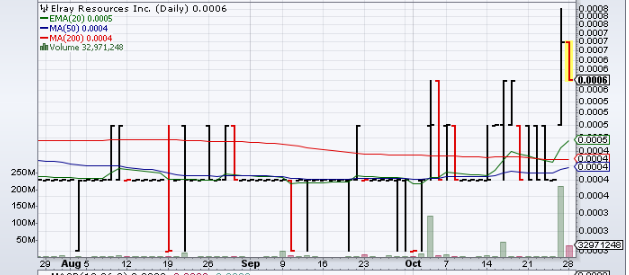

This past Friday, the Elray Resources Inc. (OTCPK:ELRA) stock emerged as one of the major gainers after it delivered gains of 55% amidst strong interest. The rally came about following a key announcement from the company, and it may be a prudent move to take a closer look into it.

Growth Strategy Milestone

Last Friday, the company announced that it had hit a major milestone in its growth strategy. Elray Resources stated that it had concluded the sale of proprietary technology to the NASDAQ-listed company 180 Life Sciences Corp. The sale had been completed through the exchange of preferred stock, which could be converted to a 40% stake in 180 Life Sciences.

Additionally, the company had also been awarded warrants by way of which it could pick up 3 million common shares in 180 Life Sciences. However, the exercise of the warrants would be allowed following approval from the shareholders.

Implications

In the news release, it was noted that the sale and the possibility of partnership in the future would boost the financial position of Elray Resources.

Moreover, the partnership would also help in supporting innovations and lead to new opportunities and revenue streams for Elray. While the balance sheet would be strengthened, the partnership with 180 Life Sciences could prove to be a significant long-term boost for Elray Resources.

Key Quote

“This strategic sale and potential future partnership are expected to enhance Elray’s financial position, support future innovation, and open new opportunities and revenue streams for the company,” said Vincent Cai, CTO of Elray Resources. “This will not only strengthen our balance sheet considerably but also enable ATNF and Elray to collaborate with leading players in the market. We look forward to announcing relationships with new operators, which will deliver even greater value to shareholders and propel our business forward.”

Fundamentals

| P/E Ratio | -3.5000 |

| PEG Ratio | -0.01 |

| Price to Book | -0.19 |

| Price to Cash Flow | – |

| Price to Free Cash Flow | – |

| Total Sales (TTM) | 0.19 M |

| Revenue per Share (TTM) | 0.00 |

| Shares Outstanding | 4.307 B |

| Share Float (%) | 3,887.40 M (90.26%) |

| % Held by Institutions | 0.00 |