Greene Concepts Inc. (OTC:INKW) Eliminates Convertible Debt: What’s the Potential Impact?

On Thursday, Greene Concepts Inc. (OTC:INKW) had been in focus following a key announcement from the company.

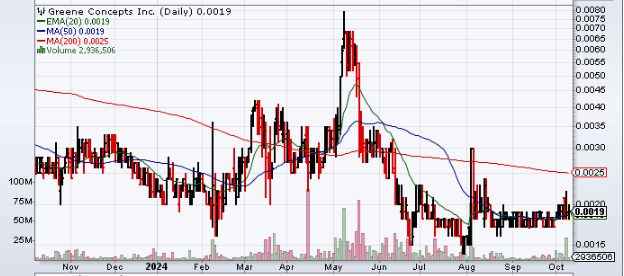

Market Action

On Tuesday, the stock went down 2% to $0.0019 with more than 1 million shares traded hands, compared to its 10-day average volume of 6.68 million shares.

Greene Concepts Cancels All Convertible Debt and Strengthens Financial Position

The company revealed that it had been successful in the removal and cancellation of all its formally outstanding convertible notes. The notes, some of which dated back to 2018, met the conditions for removal and cancellation from Greene Concepts’ financial statements and books. The conditions were reached following the end of the fiscal year on July 31, 2024.

The Maneuver

Greene Concepts announced that the removal and cancellation of the notes led to a reduction of $313,995.68 of debt. The reduction was brought about with the conversion of 6.2 billion shares at the rate of $0.0005 a share.

Potential Effect

In the news release, it was noted that the removal of the notes from the company’s books was a significant development for both Greene Concepts and the shareholders. If the note had been actually converted, around 6.2 billion shares would have gone into the market and diluted the pre-existing shares.

Through the move, Greene Concepts managed to eliminate its debt without conversion and also protected value for the shareholders. It was also a demonstration of Greene Concepts’ commitment to boosting shareholder value and managing its debts effectively. It remains to be seen if the stock gets any attention from investors today.

CEO Comment

Lenny Greene, CEO of Greene Concepts, states, “The removal of these convertible notes off our books is wonderful news for the Company and for all shareholders. Had these notes been converted, 6.2 billion additional INKW shares would have entered the market, significantly diluting existing shares. By eliminating this debt without conversion, we protect shareholder value and seek to enhance earnings per share.”

Technicals

| +/- EMA(20) | 0.0018 (+5.56%) |

| +/- SMA(50) | 0.0019 (+0.00%) |

| +/- SMA(200) | 0.0025 (-24.00%) |