High Wire (OTC: HWNI) Cancels Equity Line of Credit Worth $10 Million

The technology and managed service solutions company High Wire Networks Inc. (OTC: HWNI) was one of the companies to have come onto the radars of investors in a big way on Tuesday, and this morning it may be one of the stocks to watch out for. In this feature, we will take a closer look.

Equity Line of Credit (ELOC) Cancelled

The company announced in the news release that it cancelled the ELOC worth $10 million and went on to state that it had been a constituent of a recent package of bridge financing from a solitary investment fund. High Wire Networks also stated that as it contemplated the current necessities of the business and other events, it was ultimately concluded that an ELOC was not in its best interests.

Further Information

Following a constructive discussion, the management managed to cancel it with the investment fund on good terms. It was also noted that another factor that governed the decision was High Wire Networks’ caution about any dilution of its stock. Although the ELOC had been part of the bridge financing package, the company did not use any of the available funds.

CEO Quote

Mark Porter, President and CEO of High Wire Networks, stated, “As we look at the needs of our business going forward and the timing of all contemplated events, we feel that the ELOC is not in the best interest of our shareholders, and we do not expect it would be necessary from now on. After a short discussion, it was deemed mutually beneficial to cancel the ELOC on good terms, as we are mindful of dilution. Though it was part of the package, we did not access the ELOC.”

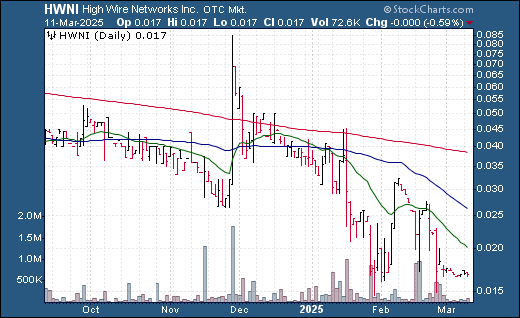

Technicals

| +/- EMA(20) | 0.0202 (-16.83%) |

| +/- SMA(50) | 0.0262 (-35.88%) |

| +/- SMA(200) | 0.0384 (-56.25%) |

| 5-Day Perf. | -2.33% |

| 1-Month Perf. | -43.43% |

| 3-Month Perf. | -66.4% |

| 6-Month Perf. | -59.02% |

| YTD Perf. | -54.72% |

| 1-Year Perf. | -76% |

| RSI(14) | 38.15 |

| ATR(14) | – |

| ADX(14) | 29.05 |

| Beta (5Y) | 0.33 |