IQSTEL (OTC: IQST) Preparing Sale of its BCHAIN Subsidiary Unit

IQSTEL (OTC: IQST) has been making considerable progress in recent times and yesterday the global telecom and technology company made a significant new announcement. The company revealed that it had started the process pertaining to the sale of its stake in the subsidiary unit, itsBCHAIN. Let’s take a closer look.

The Announcement

IQSTEL announced yesterday that it had inked an MOU (memorandum of understanding) pertaining to the sale of the entirety of its stake in its BCHAIN. The company’s holding in the subsidiary currently stands at 75%. However, it was also stated in the news release by the company that the terms of the MOU were going to be enforced following due diligence and the signing of a definitive agreement. IQSTEL stated that the transaction demonstrated its continued focus on high-margin and high-growth spaces while continuing to deliver for the shareholders.

Further Information

It should be noted that IQSTEL has worked on the monetization of the subsidiary with a strong strategic focus and decided to sell its stake in its BCHAIN for a consideration of $1 million. The sale price would be higher than the total investment that had been made by IQSTEL in the subsidiary unit initially.

CEO Comment

“This transaction marks a key milestone in our strategic roadmap,” said Leandro Iglesias, President & CEO of iQSTEL. “We are profitably monetizing a non-core subsidiary, strengthening our balance sheet, and simultaneously rewarding our shareholders by distributing a significant portion of the proceeds.”

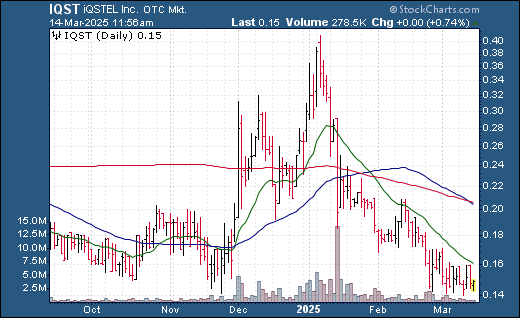

Technicals

| +/- EMA(20) | 0.16 (-6.88%) |

| +/- SMA(50) | 0.2 (-25.50%) |

| +/- SMA(200) | 0.21 (-29.05%) |

| 5-Day Perf. | -2.17% |

| 1-Month Perf. | -18.93% |

| 3-Month Perf. | -41.08% |

| 6-Month Perf. | -19.46% |

| YTD Perf. | -50.33% |

| 1-Year Perf. | -42.69% |

| RSI(14) | 38.73 |

| ATR(14) | 0.02 |

| ADX(14) | 26.11 |

| Beta (5Y) | 0.35 |