Liberty Defense Holdings Ltd (OTCMKTS:LDDFF) Stock Falls After Pricing and Terms of Overnight Marketed Offering of Units

Liberty Defense Holdings Ltd (OTCMKTS:LDDFF) on October 18, 2022, announced the pricing of the earlier announced overnight marketed offering of the firm’s units.

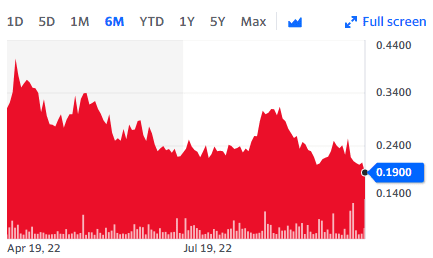

Trading Data

On Tuesday, LDDFF stock moved down 8.96% to $0.1900 with 45.57K shares, compared to volume of 42.86K shares. The stock moved within a range of $0.1805 – 0.1941 after opening trade at $0.1941.

Liberty Announces Pricing and Terms of Overnight Marketed Offering of Units

The firm aims to issue 18,182,000 Units at a price of C$0.275 per Unit for gross proceeds of C$5 million. Every unit will comprise a single common share as well as one-half of a common share purchase warrant. Every Warrant will be entitling the holder to acquire a single common share of the firm. This will be subject to adjustment in some circumstances, for a timeframe of 5 years from the Closing Date.

The Units would be provided under the restated short form base shelf and amended prospectus receipted on October 17, 2022. This was supplemented by a shelf prospectus supplement, which is to be made and filed in every Canadian province. This will not be done in the Province of Québec and by way of a private placement in the United States. Furthermore, it won’t be done in jurisdictions outside of Canada as well as the United States. This is as per the agreed terms by the company as well as the Underwriters, where the Units may be issued on a private placement basis.

Liberty Group is engaged in multi-technology security solutions for concealed weapons detection in locations entailing greater security like airports, and stadiums amongst others.

Traders Corner

LDDFF stock is trading below the 50-Day and 200-Day Moving averages of $0.22 and $0.25 respectively. Moreover, the stock is trading below the 20-Day moving average of $0.27.