Loans4Less.com Inc. (OTCMKTS:LFLS) Retains Dave Elias & Associates to Seek Strategic Alternatives

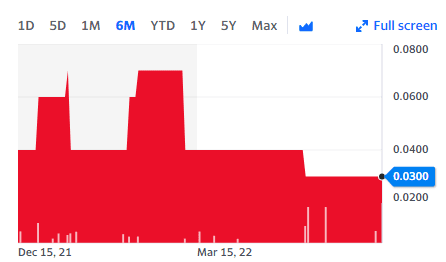

Shares of Loans4Less.com, Inc. (OTCMKTS:LFLS) have been moving within a narrow range over the past weeks. Here are key takeaways.

Market Stats

On Tuesday, LFLS stock ended flat at $0.0300 with 10K shares, compared to its average volume of 1.9K shares. The stock moved within a range of $0.0300 – 0.0300 after opening trading at $0.0300.

About The Company

Loans4Less.com, Inc. (OTCMKTS:LFLS) is an online mortgage broker based in California. It is actively focused on becoming a national origination brand platform for conforming residential mortgage programs and other consumer loans. The rates offered by the company are highly competitive, while terms and costs, daily rate updates, and other market information are thoroughly researched. It provides incredible and top-notch customer service too. It doesn’t operate a warehouse line of credit, hold trust funds, lend directly, or service loans.

The company depends on several various wholesale lenders for its retail home loan programs. It plans on swiftly expanding revenues via cost-effective advertising and engaging with a strategic partner to broaden Loans4Less a generic brand and maximize shareholders’ value at the same time.

Loans4Less.com, Inc. Retains Dave Elias & Associates to Evaluate Strategic Alternatives

Loans4Less.com, Inc. made an announcement on June 14, 2022, about retaining Dave Elias & Associates, a New Jersey-based merchant banking and advisory firm specializing in mergers & acquisitions. The purpose is so that Dave Elias & Associates can devise strategic alternatives for Loans4Less.com.

Steven Hershman, CEO of Loans4Less.com, commented that it is time to attain competitive bidding amongst commercial and retail banks, along with financial institutions that specialize in various kinds of lending programs. That is the reason they have entered into a non-exclusive agreement with Dave Elias & Associates.

Mr. Hershman further added that they have to take proper advantage of market opportunities along the way while focusing on increasing shareholder value. He emphasized that it is the right time to sell their portfolio of intangible assets, which includes Loans4Less.com, Federal Service Mark, and 60 domain names. With the proper guidance and help of Dave Elias and his team, the management plans a detailed review of the complete range of strategic alternatives that realize the full value of Loans4Less.com.

Key Quote

Steven Hershman, CEO of Loans4Less.com, stated, “In order to take full advantage of the market opportunity and maximize shareholder value, we believe it’s the right time to sell our portfolio of intangible assets, including Loans4Less.com, Federal Service Mark, and 60 domain names. With the assistance and guidance of Dave Elias and his team, we plan to review the full range of strategic alternatives that realize the full value of Loans4Less.com.”