Pennexx Foods Inc. (OTCMKTS:PNNX) Terminates its Cryptocurrency Licensing Agreement

Pennexx Foods Inc. (OTCMKTS:PNNX) is a holding company, via its wholly-owned subsidiaries, within the Software/Internet Industry that focuses on social media, prepaid debit cards, cryptocurrency, artificial intelligence, targeted marketing, and consumer rewards.

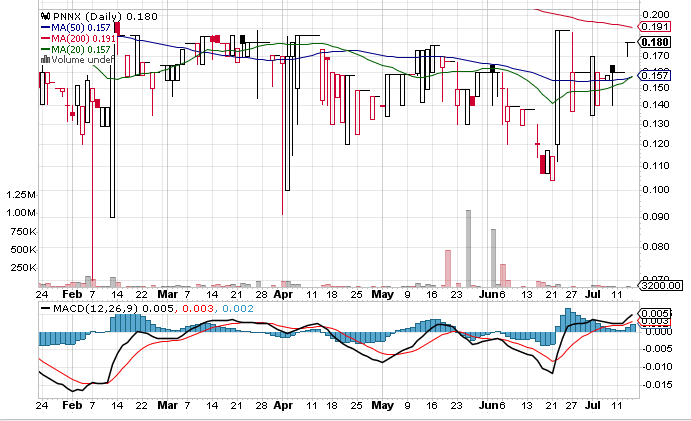

Market Stats

On Tuesday, PNNX stock ended flat at $0.16 with 10K shares, compared to its average volume of 55K shares. The stock moved within a range of $0.1600 – 0.1600 after opening trading at $0.1650.

Pennexx Announces the Continued Development and Expansion of its Own Proprietary Universal Loyalty and Rewards Program Without the Need to use Cryptocurrency Technology

Pennexx Foods announced on July 12, 2022, about deciding to end its cryptocurrency licensing agreement, which was previously mentioned in its November 15, 2021, press release. It is now working to develop an internal universal loyalty and rewards program that is to be released with a future version of its Your Social Offers software this year. The internal Rewards program includes additional features to its technology platform that will improve users’ functionality of our YSO technology.

Digital hacking is a very serious threat, especially in this day and age of uncertainty. Keeping that in mind, along with unforeseen future legislation, the Board has determined that it is beneficial for the company to develop its own proprietary system.

Vincent Risalvato, CEO of Pennexx, commented that working on the development of the company’s proprietary Universal Loyalty and Rewards program, gives them the flexibility, to provide its merchants access to the technology required to incentivize customers as well as protect against future changes or fears in the Cryptocurrency marketplaces.

Joe Ziolkowski, managing director of Relm, a Bermuda ¬based insurer that specializes in emerging risks such as those faced by digital asset enterprises, also weighs in on the development. He says that due to the electronic and proprietary nature of these assets, any cyber attacks could result in grave consequences. They could mean damage or de¬struction of data, cyber extortion, unauthorized access, and distribu¬tion of such data that can inflict considerable financial and reputational damage.

Moreover, there are potentially significant expo¬sures related to the abatement and defense of intellectual property rights. The rise of these other digital coins may create lucrative investment opportunities. However, regulatory uncertainty about the status of cryptocurrencies leaves economic transactions based on cryptocurrencies subject to regulatory attack and private litigation.

Key Quote

Vincent Risalvato, CEO Pennexx said, “By continuing the development of the companies proprietary Universal Loyalty and Rewards program the company has the highest flexibility in providing its merchants access to the technology they need to incentivize customers as well as insulating against future changes or fears in the Crypto Currency marketplaces.”

Traders Corner

PNNX stock is trading above the 20-Day and 50-Day Moving averages of $0.16 and $0.16 respectively. However, the stock is trading below the 200-Day moving average of $0.19.