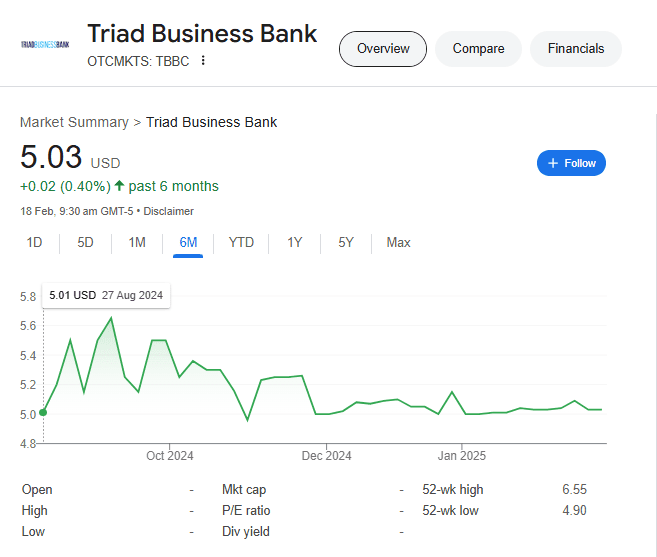

Triad Business Bank (OTC:TBBC) Stock In Focus After Reporting Quarterly Earnings

As the earnings season continues apace, it may be a good time for investors to consider keeping an eye on the latest announcements, and yesterday, it was Triad Business Bank (OTC:TBBC) that came into focus. The company announced its unaudited financial results for the 2024 fiscal year and the fourth quarter, both of which ended on December 31, 2024.

Key Takeaways

The company revealed that in the fourth fiscal quarter it had made provisions for credit loss expense of $1.7 million by setting $1.1 million worth of reserves for a corporate bond. Thanks to the provision, the net losses suffered by Triad Business Bank in the fourth quarter came in at $1.4 million. It was also noted that the corporate bond held by the bank had lost its investment grade, and the current value of the same was an indication of a credit-related issue.

Further Details

In the news release, it was also announced that the total regulatory capital with Triad Business Bank continued to be strong and stood at $63.1 million. That worked out to 12.78% of the risk-weighted assets. The net losses for the quarter stood at $1.4 million as opposed to the net losses of $800,000 in the prior year period.

CEO Comment

Ramsey Hamadi, Chief Executive Officer, commented, “The bank holds a corporate bond that recently lost its investment grade, and its current value indicates there may be a credit issue. Therefore, until there is better clarity, the bank established the $1.1 million reserve.”